Have you ever considered what happens if a commercial tenant breaks their lease? Can the landlord take back the property? This is where forfeiture of commercial leases comes in.

Forfeiture of a commercial lease lets landlords take back the property if tenants don’t meet their lease terms. It’s a big step that can leave tenants in a tough spot. But what makes it possible, and how does it work?

We’re going to explore the forfeiture of commercial lease in detail. We’ll cover what it means, its legal reasons, and how it affects everyone involved. This is key for landlords wanting to protect their property and tenants trying to keep their business safe.

So, let’s start this journey to understand commercial lease forfeiture better. We’ll look at the rights and duties of landlords and tenants and what happens if things go wrong.

Key Takeaways

- Commercial lease forfeiture lets landlords take back property if tenants break the lease.

- Common reasons for this include not paying rent, breaking lease rules, and going bankrupt.

- For tenants, it means losing the property and owing more money

- Tenants might be able to fix the issue or get help from a court

- Knowing about forfeiture is important for both landlords and tenants to protect their interests

What is the forfeiture of a commercial lease?

forfeiture of a commercial lets a landlord end a lease early and take back the property if a tenant breaks the lease rules. This is a strong way for landlords to keep their properties safe and in control.

Definition of Lease Forfeiture

Lease forfeiture means a landlord ends a lease early because the tenant didn’t follow the lease rules. When a landlord uses this right, the tenant can’t stay in the property anymore. The landlord can go back into the space.

Reasons for Forfeiture

A landlord might end a commercial lease for several reasons, such as:

- Not paying rent on time

- Breaking lease rules, like making changes without permission or causing trouble

- Going bankrupt or entering administration

It’s important for landlords and tenants to know about commercial lease forfeiture and why it happens. Understanding their rights and duties helps them avoid or deal with lease problems.

TSP has a growing portfolio of high-yielding value-add opportunities in direct real estate investment. They manage over 30 properties, covering approximately 2 million square feet, and always leave assets in a better state than they found them.

If a tenant doesn’t meet their lease duties, the landlord can end the lease and take back the property. This can be a big problem for both sides. Tenants might lose their business place. Landlords need to follow the law carefully to end the lease successfully.

Landlord’s Right to Forfeiture of Commercial Lease

As a landlord, you can end a commercial lease under certain conditions. This power comes from the law and the lease agreement. It’s key to know these rules to handle the process well.

Legal Basis for Forfeiture

The right to end a lease comes from a special clause in the lease. This clause lists when the landlord can take back the property. Reasons include not paying rent or breaking lease rules.

Statute law also backs the landlord’s right to end a lease. The Law of Property Act 1925 and the Landlord and Tenant Act 1954 set the rules in England and Wales.

Conditions for Exercising Forfeiture

To end a lease, you must meet some conditions:

- The tenant must have broken a lease rule, like not paying rent or breaking a covenant.

- The breach must be severe enough to end the lease. Small mistakes might not be enough.

- You must tell the tenant about the breach and allow them to fix it within a set time.

- You can end the lease if the tenant doesn’t fix the issue by the deadline.

Ending a lease is a big step. It’s essential to be careful. Getting advice from experts like TSP can help you do it right and avoid legal problems.

TSP is the UK’s top advisor for charities and non-profits. They bring private sector best practices to charities in a safe, easy way. Their team uses years of experience to help leaders and Trustees make smart choices with their commercial properties.

Knowing the laws and conditions for ending a lease helps you handle it when tenants don’t meet their duties. This includes not paying rent or breaking lease rules.

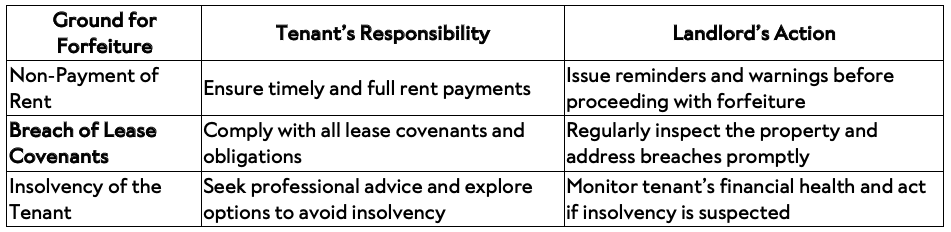

Common Grounds for Forfeiture of Commercial Lease

The landlord can terminate the lease if a tenant fails to adhere to the terms of their commercial lease agreement. There are several reasons for this, each of which has significant implications for both parties. Tenants must be aware of these reasons to comply with their lease and prevent the risk of losing it.

Non-Payment of Rent

Not paying rent on time is a big reason for the lease ending. If a tenant doesn’t pay rent, they break their lease. Landlords can then take steps that might end the lease and let them back in.

To avoid this, tenants should pay rent on time and talk to their landlord if they’re having trouble. Landlords should have a plan for dealing with late rent, like sending reminders before ending the lease.

Breach of Lease Covenants

Commercial leases also have rules that tenants must follow. These rules cover how to use the property and what repairs are needed. Breaking any of these rules can lead to the lease ending.

Some examples of lease breaches include:

- Unauthorised changes to the property

- Not keeping the property in good shape

- Using the property for the wrong reasons

- Subletting without permission

Tenants should read their lease carefully and follow all the rules. Landlords should check the property often and talk to tenants to fix any issues early.

Insolvency of the Tenant

Being insolvent is another reason a lease can end. The landlord might end the lease if a tenant can’t pay rent because they’re insolvent. An insolvent tenant can’t pay rent and might risk the landlord’s property.

Tenants in trouble should get advice and look into things like CVAs or restructuring. Landlords should monitor their tenants’ money situation and act fast if they think a tenant might go insolvent.

Knowing why leases can end and how to avoid them helps tenants and landlords. Keeping in touch, acting quickly, and following the lease rules are essential. This way, everyone can have a good lease agreement.

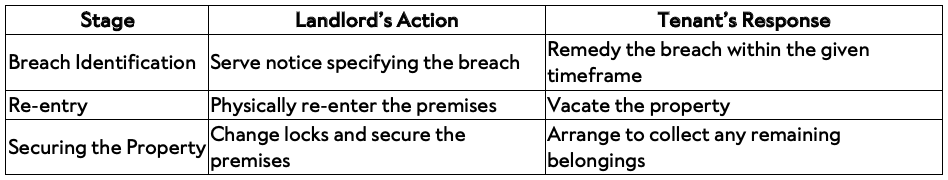

The Forfeiture Process

If a tenant breaks a commercial lease, the landlord can start the forfeiture of commercial lease process. This means following specific steps to legally end the lease.

The first step is giving the tenant a notice. It says what the tenant did wrong and asks them to fix it. The landlord can take further action if the tenant doesn’t fix it.

Then, the landlord can go back into the property. They can do this peacefully or with a court order. After getting back in, they make sure the property is safe.

It’s important for landlords to follow the law when they take back a commercial lease. This helps avoid legal problems.

The main steps in the process are:

- Identifying the breach and serving notice

- Letting the tenant fix the issue

- Going back into the property

- Making the property safe

- Dealing with the tenant’s things left behind

Landlords should think about the risks and benefits of forfeiture of commercial lease. They must follow the law to protect their rights and avoid disputes.

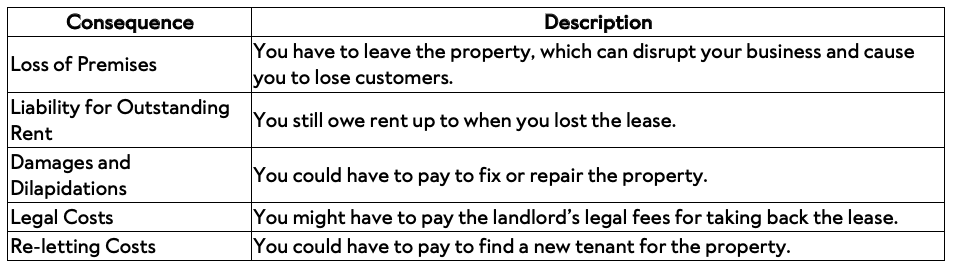

Consequences of Forfeiture for Tenants

When a landlord takes back a commercial lease, it can be not suitable for the tenant. Tenants need to know what can happen and how to avoid it. Losing the place and having to pay what you owe are the big problems.

Loss of Premises

One big issue is losing the place you work from. After the landlord takes back the lease, you must leave quickly. This can damage your business, as finding a new place fast is hard.

You might lose customers or clients too. Moving suddenly can cause extra costs and make you lose time.

Liability for Outstanding Rent and Costs

Another big problem is having to pay what you owe. This includes:

- Unpaid rent up to when you lost the lease

- Any damages or damage to the property

- Legal costs the landlord paid in taking back the lease

- Costs to find a new tenant

This can be very expensive, especially if you are behind on rent. Knowing your lease well and getting advice if you’re having trouble is critical.

Forfeiture can really affect tenants a lot. It’s important to follow the lease and talk to your landlord to avoid this.

Options for Tenants Facing Forfeiture

As a tenant, facing the threat of losing your commercial space can be scary. But you have ways to fix the problem and might keep your space. We’ll look at two main ways: fixing the issue and asking for help to avoid losing your lease.

Remedying the Breach

One good way to stop losing your lease is to fix the problem fast. If you’re behind on rent, talk to your landlord and make a plan to pay off what you owe. This could mean setting up a payment plan or finding help with money.

If you’ve broken other lease rules, fix it right away. Make sure you follow your lease’s rules again.

Seeking Relief from Forfeiture

Some tenants can ask a court for help to avoid losing their lease. This means asking the court to let you stay in the space. The court looks at things like:

- The type and seriousness of the breach

- Your actions and effort to fix the breach

- The trouble you’d face if you lost the lease

- Your landlord’s actions and if they were fair

Getting help from the court to avoid losing your lease is complex and urgent. It’s wise to get legal advice to look at your options and aim for the best result.

If your commercial lease might be taken away, act fast and look at all your choices. Know your rights, talk to your landlord, and fix the issue quickly. This way, you can try to keep your lease and protect your business.

Preventing Forfeiture: Tenant’s Responsibilities

As a tenant, knowing your duties is key to avoiding commercial lease default and re-entry by the landlord. Stay informed and act fast to keep a good relationship with your landlord. This way, you can dodge the harmful outcomes of lease forfeiture.

One fundamental way to stop lease forfeiture is to pay rent on time. Use automatic payments or set reminders to help you remember. If you’re having trouble paying, talk to your landlord early to find solutions or temporary help.

Make sure you follow all lease rules and duties. This includes keeping the property nice, having the right insurance, and using it as agreed. Know your lease well and ask your landlord or a lawyer if you’re unsure.

“An ounce of prevention is worth a pound of cure.” – Benjamin Franklin

If you notice any issues that could lead to the forfeiture of the commercial lease, address them promptly. Openly communicating with your landlord can prevent problems from escalating and potentially avoid a lease termination.

To keep your tenancy safe, do these things:

- Have a special account for rent to make sure money is always there.

- Regular checks on the property are done to fix any upkeep issues quickly.

- Keep all letters and deals with your landlord in order.

- Get advice from a lawyer who knows about commercial property law to know your rights and duties.

By being proactive, careful, and talking to your landlord, you can greatly lower the chance of commercial lease default. This helps you keep a steady and successful tenancy.

Forfeiture of Commercial Lease: A Landlord’s Perspective

As a landlord, knowing your rights about the forfeiture of a commercial lease is key. Forfeiting a commercial lease can help protect your interests. But, think carefully about the good and bad before you act.

Advantages of Forfeiture for Landlords

Forfeiting your lease lets you take back your property if a tenant breaks the agreement. This is useful if tenants pay rent late or damage the property. You can avoid losing money and find a better tenant this way.

Risks and Considerations for Landlords

Forfeiting a lease has its ups and downs. It can be a long and expensive legal fight, especially if the tenant fights back. You could also face claims of wrongfully forfeiting, causing more legal trouble. Always get legal advice before taking this step to make sure you’re right and protect your business.

FAQ

What is Forfeiture of Commercial Lease?

forfeiture of a commercial means a landlord ends a lease early if a tenant breaks the lease rules. This can be for not paying rent or breaking other lease rules. The landlord then takes back the property, and the tenant can’t stay there anymore.

What are the common grounds for commercial property forfeiture?

Common reasons for forfeiting a commercial lease include not paying rent, breaking lease rules, and the tenant going bankrupt. If a tenant doesn’t follow the lease, the landlord can end the lease early.

What are the consequences of forfeiture for tenants?

Forfeiture is bad news for tenants. They lose their right to be in the property and must pay any rent they owe plus legal fees. It can also harm their business and reputation.

Can tenants seek relief from forfeiture?

Yes, tenants can ask the court for relief from forfeiture. If the court says yes, the tenant can stay in the property if they fix the problem and pay what they owe.

How can tenants prevent forfeiture?

To avoid forfeiture, tenants must follow the lease rules, pay rent on time, and stick to the lease rules. Talking to the landlord and solving problems quickly can also help.

What are the advantages of forfeiture for landlords?

Forfeiture lets landlords take back their property if tenants don’t follow the lease. It helps landlords avoid losing money from tenants who don’t pay. They can then find new tenants who will follow the lease.

What risks should landlords consider before initiating forfeiture?

Landlords should think about the risks of starting forfeiture. These include legal fights from tenants, the cost of court cases, and having the property empty while looking for new tenants. Getting legal advice is key to following the law and reducing risks.

Forfeiture for non-payment of rent is a landlord’s right to reclaim their property when the tenant fails to fulfil their financial obligations. This process can be complex and usually involves legal procedures. It is always recommended that landlords seek legal advice and follow the proper protocols when considering forfeiture as an option for commercial tenancy repossession.

How can TSP Help

TSP can prepare the necessary documentation for lease termination for breach, ensuring that all legal requirements are met and minimising the potential risks for the landlord. By working closely with experienced lawyers, TSP can provide valuable guidance on the landlord’s right to forfeit the lease and the process of re-entry by the landlord.

Before initiating forfeiture, landlords should be aware of the potential risks involved. Forfeiture is a drastic measure, and if not done correctly, it can lead to legal complications and even financial loss. One key risk is the possibility of the tenant challenging the landlord’s right to forfeit the lease. This can occur if the landlord has not followed the proper procedures or if there are disputed facts regarding the alleged breach of the lease.

Another risk to consider is the potential impact on the landlord’s reputation. Forfeiture actions can be viewed negatively by tenants, industry professionals, and the public. Landlords may face criticism and damage to their professional relationships, leading to difficulties in attracting future tenants or securing financing for their properties.

Additionally, landlords should consider the financial implications of forfeiture. If a tenant successfully challenges the landlord’s right to forfeit, the landlord may be responsible for the tenant’s legal costs. Moreover, even if the landlord is successful in reclaiming the property, there is no guarantee that a new tenant will be found quickly, resulting in a loss of rental income.

In conclusion, landlords should carefully evaluate the risks associated with forfeiture of commercial lease before initiating lease termination for breach. Seeking legal advice and working with professionals like TSP can help ensure that the process is handled correctly, minimising potential risks and maximizing the chances of a successful outcome for the landlord.

Featured Stories & Insights

5th September 24

5th September 24

3 Ways To Keep Your Commercial Property Green

Sustainability – it’s not just a buzzword anymore. It’s a game-changer for commercial properties. Wondering...

Read More 5th September 24

5th September 24

TSP hosts ‘Back to Work’ rooftop evening: A toast to the past and a cheers to the future

On Wednesday 4th September, TSP hosted a celebratory rooftop evening in the heart of Central...

Read More 12th July 24

12th July 24

TSP Celebrates 15 Years: Q&A With Zac Goodman, Founder & CEO

This year celebrates TSP’s 15th Birthday. Co-founded by Zac Goodman in 2009, the business emerged...

Read More 5th July 24

5th July 24

Can ‘core to floor’ move the dial in a polarised office market?

AS FEATURED IN ESTATES GAZETTE, 04.07.2024 “A core-to-floor approach is the middle ground office landlords...

Read More 2nd June 24

2nd June 24

‘Core to Floor’: The Latest Strategy Helping Landlords Keep Their Buildings Fuller For Longer

Traditional long-term leases and hands-off landlords don’t meet modern occupiers’ needs. These assets are struggling....

Read More 30th May 24

30th May 24

People talk about “customer-centric”, but what is it?

The term “customer-centric” is often thrown around, but what does it actually mean – especially...

Read MoreView all