They show key secular trends that landlords & their advisers must adapt to…

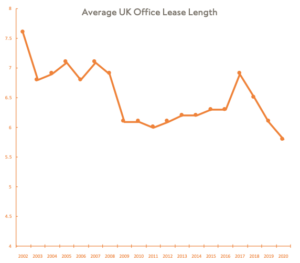

1. Office Lease Lengths Are Getting Shorter

We knew this before the pandemic. Now leases are even shorter. In 2019, the average lease length was just over 6 years. During the pandemic, real-time metrics showed average lease lengths as low as 30 months (not including coworking).

The chart is trending downwards because of coworking, managed space, Cat A+, WFH, hybrid, and – most important – uncertainty.

When lease events are more frequent, there is more renegotiation, and your space will be on the market more often.

So buildings must always attract new customers, or even better, keep existing customers within their ecosystem at renewal, at higher rents…

How?

• Do the basics better than anyone

• Build deeper relationships with customers (meet them, email, market to them)

• Create an irresistible offer

• Invest in your marketing strategy

Now chart 2…

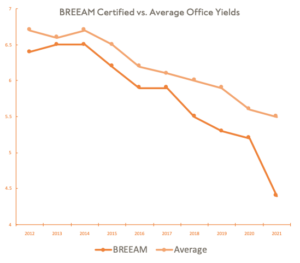

2. Sustainable Buildings Are Worth More

Careful with this one – it’s not conclusive.

There is an emerging premium for green assets – investors will pay more for offices with higher BREEAM ratings, shown by the yield spread in Europe.

Knight Frank also found that BREEAM outstanding buildings achieved a 12.3% rental premium.

But new buildings are worth more AND they have the best BREEAM ratings. We don’t yet know which is more important – the data will be conclusive in a few years.

It is logical that investors & occupiers pay more for green buildings. The focus on CSR, ESG, the climate crisis, MEES regulations, and energy price inflation all feed this chart.

So try to make your building as green as possible. Then market those features:

• The ‘difficult’ & expensive things (retrofitting, increasing the EPC score)

• The ‘easier’ stuff (waste management, offsetting, community engagement, utility monitoring, etc)

In summary…

Monitor and adapt to these trends.

You’ll lease space faster, at a higher rent, and your buildings will be worth more.

Written By Jonathan Vanstone-Walker

Featured Stories & Insights

19th June 25

19th June 25

As Featured in: Flex and the City | How Zac Goodman made his mark in third sector property

TSP Founder and CEO Zac Goodman shares his remarkable journey. From analysing interest rates at...

Read More 17th June 25

17th June 25

TSP and NORNORM Collaborate to Redefine Office Spaces in London

LONDON, 17th June 2025 – TSP, a leader in property and community management, has announced...

Read More 12th June 25

12th June 25

6 Mistakes to Avoid in Property Maintenance

Property management and maintenance can be a seamless process. But small errors can quickly escalate...

Read More 9th June 25

9th June 25

5 Common ESG Requirements and How To Address Them

As ESG considerations become a driving force in business, organisations are under increasing pressure to...

Read More 2nd June 25

2nd June 25

SORP Changes: How Will It Impact Charity Real Estate?

Big changes are coming for how charities manage and report their leases. From January 2026,...

Read More 27th May 25

27th May 25

5 Ways Modern Flex Offices Boost Tenant Satisfaction

The workplace has evolved, and so have employee expectations. Teams want environments that inspire, adapt,...

Read MoreView all