They show key secular trends that landlords & their advisers must adapt to…

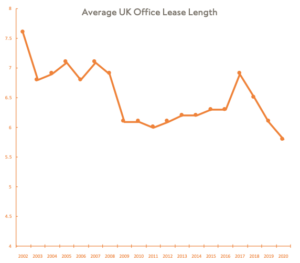

1. Office Lease Lengths Are Getting Shorter

We knew this before the pandemic. Now leases are even shorter. In 2019, the average lease length was just over 6 years. During the pandemic, real-time metrics showed average lease lengths as low as 30 months (not including coworking).

The chart is trending downwards because of coworking, managed space, Cat A+, WFH, hybrid, and – most important – uncertainty.

When lease events are more frequent, there is more renegotiation, and your space will be on the market more often.

So buildings must always attract new customers, or even better, keep existing customers within their ecosystem at renewal, at higher rents…

How?

• Do the basics better than anyone

• Build deeper relationships with customers (meet them, email, market to them)

• Create an irresistible offer

• Invest in your marketing strategy

Now chart 2…

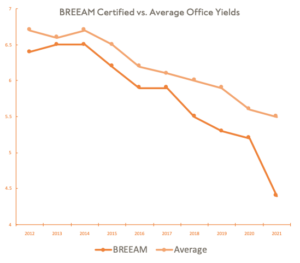

2. Sustainable Buildings Are Worth More

Careful with this one – it’s not conclusive.

There is an emerging premium for green assets – investors will pay more for offices with higher BREEAM ratings, shown by the yield spread in Europe.

Knight Frank also found that BREEAM outstanding buildings achieved a 12.3% rental premium.

But new buildings are worth more AND they have the best BREEAM ratings. We don’t yet know which is more important – the data will be conclusive in a few years.

It is logical that investors & occupiers pay more for green buildings. The focus on CSR, ESG, the climate crisis, MEES regulations, and energy price inflation all feed this chart.

So try to make your building as green as possible. Then market those features:

• The ‘difficult’ & expensive things (retrofitting, increasing the EPC score)

• The ‘easier’ stuff (waste management, offsetting, community engagement, utility monitoring, etc)

In summary…

Monitor and adapt to these trends.

You’ll lease space faster, at a higher rent, and your buildings will be worth more.

Written By Jonathan Vanstone-Walker

Featured Stories & Insights

30th January 26

30th January 26

Data, Demand & the Future of Office Performance

In conversation with Greg Blanchard, Portfolio Manager at TSP Data has become a big theme...

Read More 28th January 26

28th January 26

Goodman’s TSP Goes Nationwide with KSA Acquisition

LONDON, 20th January 2026 | News by Tim Burke, EG TSP, the office-focused property manager...

Read More 8th January 26

8th January 26

Business Rates are Changing in April: 4 things charities should watch for

Business rates are being reset in April 2026, and for charities this is a direct...

Read More 8th January 26

8th January 26

4 Ways to Win the Office Game in 2026

The office market is recovering, but not evenly. As we move into 2026, one thing...

Read More 17th November 25

17th November 25

Lessons Learnt from 2025 | by Zac Goodman

The market shifted (again), expectations changed (again), and the way people use space evolved in...

Read More 10th November 25

10th November 25

From Vauxhall to Value: How Aldgate Became London’s Charity Heartland

TSP’s Jonathan shares his perspective on why Aldgate has become the go-to destination for London’s...

Read MoreView all